Will the DSA implementation drive Online Marketplaces back to 2010? How the “45 million users” rule might impact Technology…

Will the DSA implementation drive Online Marketplaces back to 2010?

The conversation about the benefit of Central P&T is the longest running “will they – won’t they” plot in the history of the online marketplaces. DSA adds an extra twist.

How the “45 million users” counting rule for the VLOPs might impact Technology Platforms development and drive Fragmentation and Market Divergence of the Online Marketplaces in Europe?

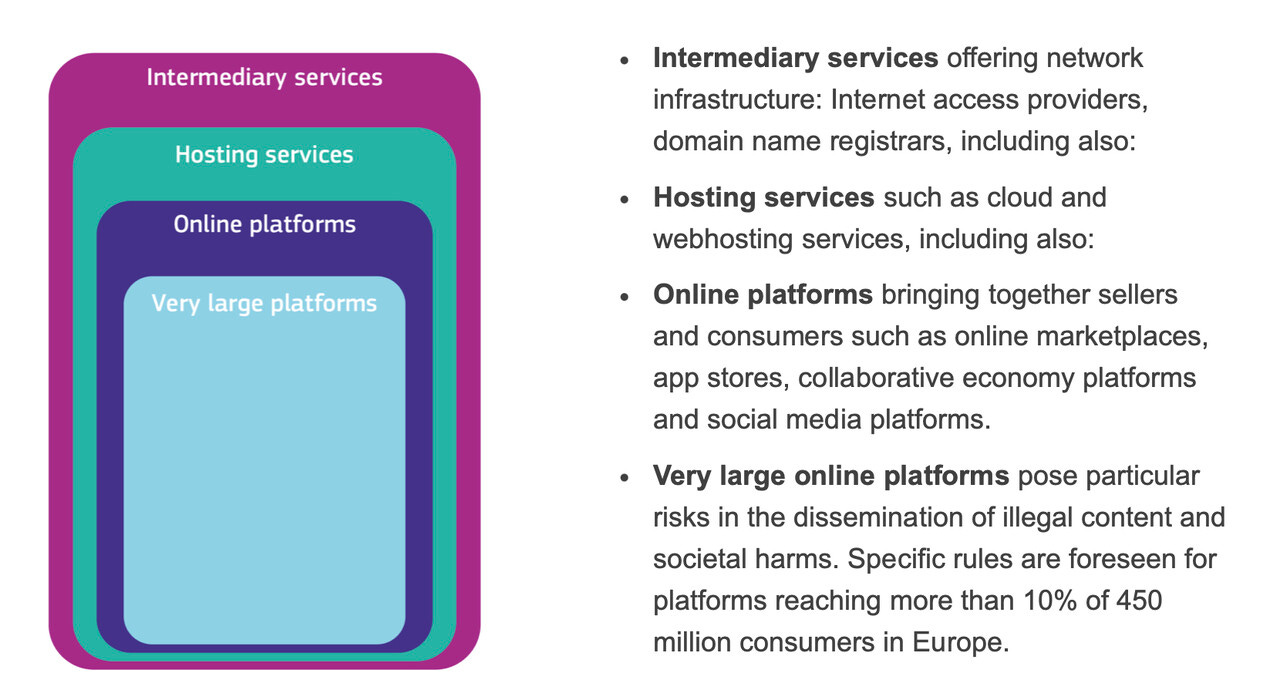

Yesterday, the European Commission has published the list of the Very Large Online Platforms (VLOPs): those reaching more than 10% of 450 million consumers in Europe and seen as posing particular risks in the dissemination of illegal content and societal harms.

Not surprisingly, all the major global platforms from Google to TikTok have made the list. Interestingly for the Online Marketplaces, only several of the well-known brands operating in Europe are on the list of VLOPs and are expected to comply with complex regulatory requirements within the coming four (!) months.

We see Alibaba Express, Amazon Store, Booking, and Zalando on the list of the Very Large Online Platforms that reach at least 45 million monthly active users in the EU area. What do these platforms have in common?

One brand, one technology platform, one website (country-specific versions notwithstanding), shared content visible across EU users.

Who are the Online Marketplace platforms that DID NOT make it to this list?

Leboncoin.fr (29 million monthly active users), eBay Kleinanzeigen (36 million), OLX Poland (18 million) – the list can continue; one thing is clear – these are the platforms that use separate Technology platforms (and often brands) per country, even though they are all part of larger companies providing service at the total scale of 45 million+ monthly customers in Europe.

Zalando operates a shared marketplace across Europe and has reached 50 million active customers. According to Similarweb, 24% of its traffic comes to Germany, 14% from Poland, and each of the other European countries accounts for less than 10% of the audience. In other words, had Zalando been running separate platforms in those countries, it would have been seen as a set of 12 million / 7 million / and less companies and would not been hit with the most stringent regulatory requirements.

How will the business case for a shared Technology platform differ going forward, when the costs of DSA regulatory requirements are taken into consideration?

Let’s make a simple decision-making model by comparing scenarios for an online marketplace that operates in 10 markets, of which 3 are large (10 million users each), and 7 are small (3 million users each). Its operating margin is 37% when all country operations are independent.

If this marketplace were to operate as one platform / one brand across EU, it would serve 51 million users and would meet the costly compliance criteria of a VLOP.

However, moving 6 out of the 10 markets to one platform would keep the number of users just under the threshold.

I use a simple hypothetical scenario:

- higher compliance from hitting 45 million users costs 2ppt of the margin;

- shared platform and brand infrastructure increases the margin by 4ppt.

How strongly might the compliance requirements influence Technology Platform decisions in this context?

The simple answer is - not strongly. A fragmented platform with low compliance costs runs at 37% margin, while a shared platform with high compliance costs at 39% margin, still worth the investment.

Things get more interesting when we consider the strategy of “a shared platform just under the 45 million user threshold.” With the same starting point, a high growth (25% CAGR) company has much less incentive to merge their platform than a slowly growing one (5% CAGR), gaining a full 1ppt difference (39% vs 40% margin).

So, the answer to this question – will DSA influence Technology Platform decisions – is a definite yes for high-growth companies, who will think twice before switching to the benefits of shared platform due to increased compliance costs.

A more nuanced picture will appear for the more established, low-growth businesses. If they are expecting low long-term growth and will not enter the VLOP territory, it might be worth taking the risk of platform merge to simplify operations and control the EBITDA.

What does this mean for the future outlook of Marketplaces fragmentation across Europe? Will the same large players continue having a strong presence, but stop investing into advanced shared Technology platforms? Or will this bring a true diversity of offering?

Thoughts? Please share in the comments!