Is Transactional Model a Profitability Killer for Online Marketplaces?

The Rise of the Transactional Marketplace Model and its Impact on Profitability: 2022 lessons from Allegro, Adevinta, Bol.com, OLX, and Schibsted

What is the implication of a Transactional Model for the Marketplaces Profitability?

Looking through the 2022 financial reports, the following picture emerges.

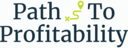

In Norway, Schibsted has reported that the transactional model has been driving revenue growth while diluting the margin, specifically pointing out Product Development investments needed for further growth.

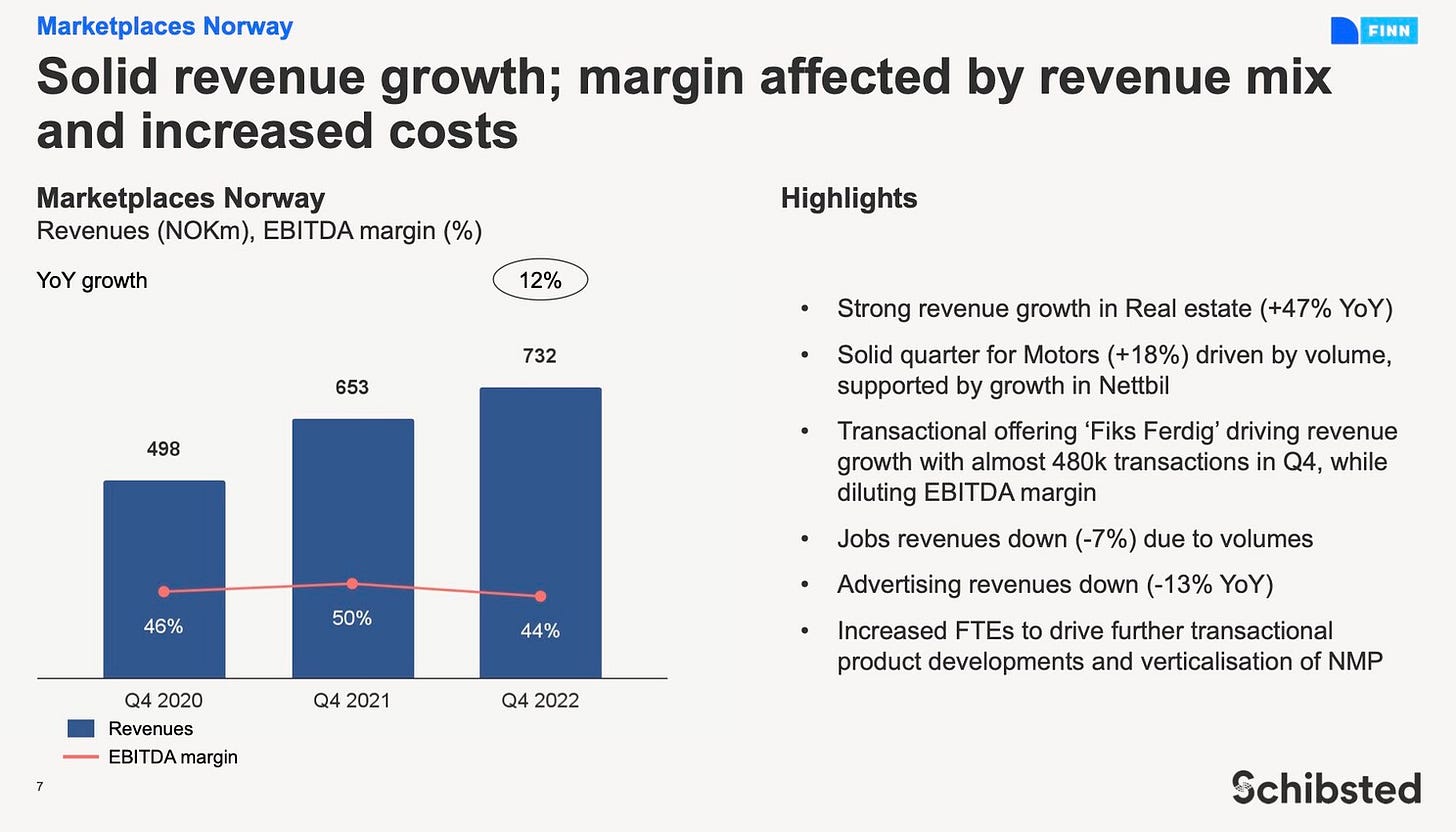

In France, Adevinta similarly reported that the transactional model has been loss-making for leboncoin, but that it did reach a break-even on the unit economics of by the end of 2022. As of January 2023, leboncoin introduced a 4% buyer fee for purchases in Fashion categories and restricted shipment eligibility requirements, further supporting the path to profitability of the transactional model.

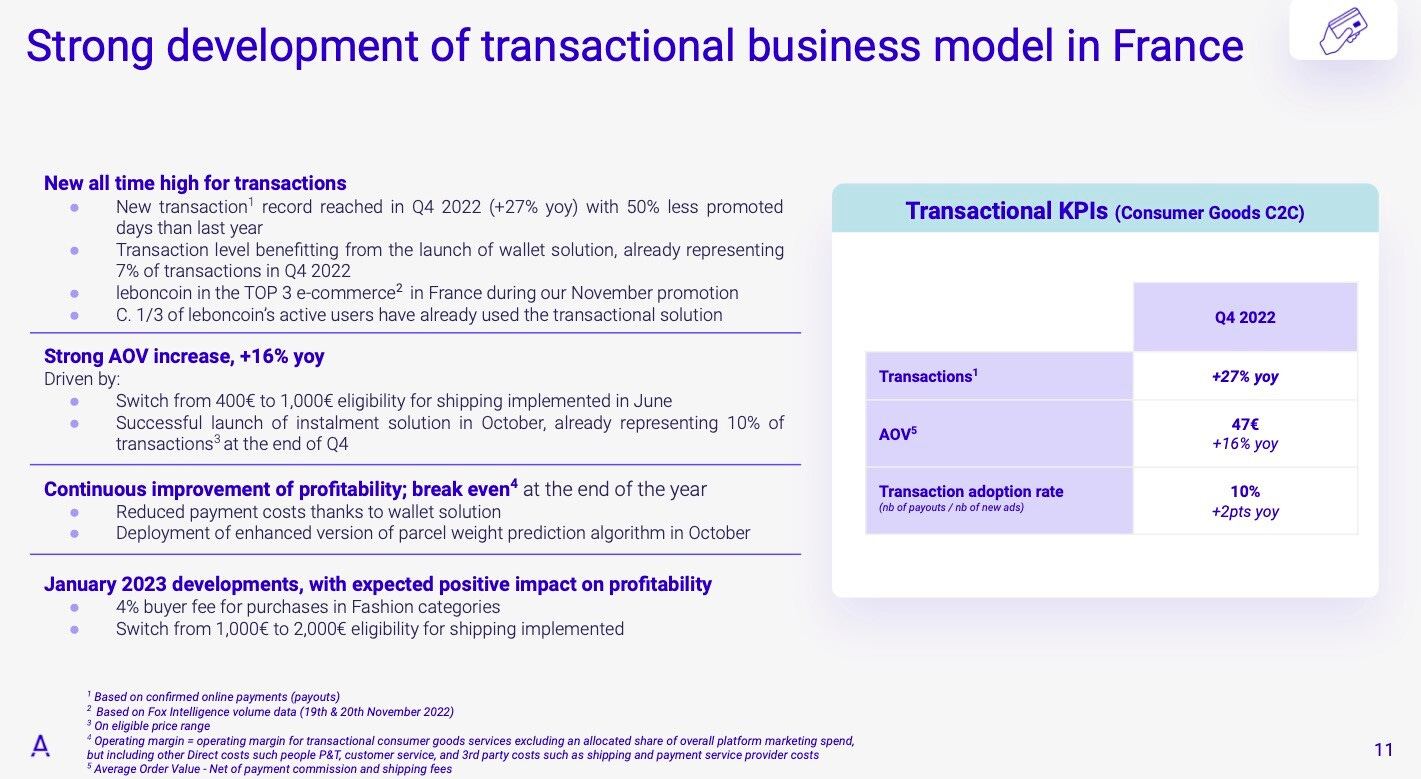

Elsewhere across Europe, Prosus has reported a significant volume of adoption of the Pay and Ship solution by OLX customers, paired with a negative unit economics that is due to turn positive towards FY2026.

While improving YoY, OLX Pay and Ship take rate of 3.2% is significantly behind the market standard. For comparison, Allegro Poland – who shares a key market with OLX and operates the largest B2C transactional marketplace with a C2C offering – reported their take rate to be 11% in Q4 2022.

Some of the gap can be explained by the differences in the logistical infrastructure (which Allegro operates and OLX does not). Another possible explanation is the complexity of operating in multiple markets with fragmented delivery services – which may explain why OLX lags behind the one-country business like leboncoin in France, who has already reached a break-even on the transactional model in 2022.

What are the lessons from the B2C Transactional Marketplaces?

C2C Marketplaces have reported significant growth in their transactional models: 65% YoY at OLX, 154% at eBay Kleinanzeigen, 33% at leboncoin. It is important to remember that this growth comes from introducing a new model and a relatively low base. For the established B2C marketplaces with the transactional model, growth looks more challenging. Monetization and profitability improvement is the key priority.

Allegro delivered 14% growth in GMV in Poland, driven mainly by the increased Take Rate (co-financing and success fee changes lifted it by 1.06ppt), higher Average Order Value (+11.3% YoY, guided by incentives and promotions), and growth of the Advertising Revenue (+29.7% YoY) – taking a page out of the Classifieds playbook, where listing promotions already generate a significant share of revenues. With a difficult economic outlook and a negative consumer sentiment, Polish Retail growth slowed down in 2022 to 15%, and Allegro GMV grew largely in line with the market.

In the Netherlands, Bol.com struggled in the difficult market and reported a GMV decline of 1.9%. It continued operating profitably (although its EBITDA was almost 30% down YoY). Growing revenue streams for bol.com were internal advertising (70% YoY revenue growth from sponsored products) and logistics services (20% YoY growth) for its third-party marketplace.

Allegro Q4 results presentation has reiterated its focus on improving profitability. While the take rate has increased to 11%, and Product and Technology investments are flattening out, net delivery costs as share of Allegro revenues continue to increase and are the biggest threat to profitability.

Allegro Poland EBITDA margin has decreased from 51% in 2019 to 33% in 2022. A large proportion of this margin dilution has come from the increased share of net delivery costs, rising from 10% of revenues in 2019 to 26% of the revenues in 2022. Getting the logistics and the customer experience right has been costly. In addition, Allegro SMART! subscription, inspired by Amazon Prime, has increased engagement but diluted margins since free delivery offering for 4.99 PLN a month is loss-making. While additional revenue streams like financing or sponsored listings can partially compensate for this, ultimately the standalone unit economics of delivery services will define whether transactional model can become and stay profitable.

Is Transactional Model a Profitability Killer for the Classifieds Marketplaces?

In short, the answer is a bit of a yes. The Classifieds Marketplaces of the 2010s, with their near 60% EBITDA margins, do not represent the future marketplace businesses that rely on the transactional model. The higher margins of the vertical businesses – Automotive, Real Estate, Jobs – will continue compensating for the profitability dilution in the General Goods category. Increased expansion of the locker-to-locker delivery services and consumer acceptance of service/success fees in the C2C trade will support profitable and sustainable operations, but at a significantly lower margin.