Can a truly ambitious Transformation be successful? The ING Orange Bridge story

ING Orange Bridge Case Study: can a truly ambitious Transformation be successful?

Let me start with a controversial punchline: Every Transformation is Destined to Fail – if it's significant enough to be considered a genuine change. Paradoxically, the very elements that contribute to its success, such as ambitious goals, open communication, thoughtful planning, and strong leadership, are also the factors that can ultimately lead to its downfall.

To make the discussion tangible, I will use a case study of the “Orange Bridge” platform of the ING Bank – one of the more expensive Digital Transformation projects that did not turn out as planned.

So, what are the Four Transformation Paradoxes driving every successful – and failed – transformation?

1. the Big Dream Paradox:

setting grand goals will end in a failure, yet incremental goals won’t deliver change. A Big Dream, inspiring and well-described at the start of a transformation, might turn out to be an outdated Nightmare when the transformation finally gets there.

2. the Communication Paradox:

being open about the tough journey ahead builds the trust, yet such openness also decreases support for the transformation.

3. the Expertise Paradox:

change management expertise is critical for driving a transformation, yet no successful transformation followed a change management playbook.

4. the Leadership Reward Paradox:

leaders who successfully drive big transformations end up with a changed business they are not well-suited to lead. A leader’s reward for a successful transformation is not leading a better business – it’s being replaced.

Agree? Disagree? Have examples in support, or counterexamples to prove me wrong? Please share them in the comments!

Let’s get to the Orange Bridge story.

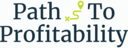

The goal of the “Orange Bridge” project was integrating IT systems between the Dutch and the Belgian branches of the ING bank.

The Orange Bridge journey started in 2016 with a grand vision of a Unified Cross-Border Banking Platform for managing mortgages, business services, and online banking. ING was to become the largest bank in the Benelux, integrating its businesses in the Netherlands and in Belgium onto one omnichannel platform, but also using the language of “one bank” to show the operational integration. The analysis below uses ING Investor Day presentations, as well as an investigation published by Het Financieele Dagblad (in Dutch, 13/06/2020).

ING allocated a budget of €450 million for this transformation. From 2021 onwards, Orange Bridge was to deliver annual savings of €550 million. 2016 Investor Day Presentation shared the details on the vision, implementation, and financial milestones.

How did it do on a scale of Grand Transformations?

Grand Goal? Check.

Well-defined impact and deliverables on a 5 year+ horizon? Check.

Focus on process improvement and improved customer experience? Check.

Board buy-in? Check.

Well, things did not quite go as planned.

First, the National Bank of Belgium (NBB) blocked the plan of reducing the autonomy of the Belgian management and moving key functions to Amsterdam. As a result, the planned cost synergies were no longer realistic.

The culture clash between the Belgian and the Dutch management furthered the tensions. From Amsterdam, the management culture of ING Belgium was seen as conservative, hierarchical, and resistant to digitalization, insisting on the old-fashioned physical offices and relationship banking. From Brussels, the Dutch leadership was seen as arrogant, launching a huge digital transformation from their “ivory tower” without understanding Belgian regulation, market, or technical complexities involved.

The veto of the NBB left the project without a clear ownership mandate, since both Brussels and Amsterdam were to be involved and no one country were to be end-responsible. ING Digital Transformation executives were getting demotivated, and by 2018 and 2019 three senior executives from both sides of the border have left the bank.

Furthermore, missing the significant 2019 savings target was generating concerns for the Belgian employee unions, who suspected that employee redundancies will replace the IT systems as the source of the future P&L improvements.

How does this journey reflect on the Four Transformation Paradoxes?

1. The Big Dream of a Unified Cross-Country Banking Platform delivering half-a-billion-euro annual savings was grand, clear, and well-defined.

However, the implementation required a significant revision when the details of the local regulation, market dynamics, technology solutions, and the governance were considered. It took two years to clarify that while the Big Dream had the right to exist, some of its core assumptions had to change for it to be successful.

2. The Communication of the journey ahead has been a case study in mutual mistrust, forced change and a resulting increased resistance, demotivating both the bank employees potentially affected by the upcoming change but uncertain about its effect on their jobs, and the bank leaders who were not able to make strides on one of the most significant programs for the bank.

3. The Expertise for the project implementation focused on Technology transformation, while the bottleneck started in a different place: regulation and governance requirements, resulting in a National Bank intervention citing national interests rather than IT topics. With all the right expertise and planning in place for a Technology project, this turned out not to be a Technology Transformation, and could not move forward as such.

4. The Leadership Reward is a painful illustration of the reputation damage for the outgoing ING CEO from the failed Grand Transformation. As the Financieele Dagblad (the main business publication in the Netherlands) points out, this was supposed to be his Crown Jewel of successful digitalization. Instead, the headline of their 2020 article was “Digitale toekomstdroom ING-topman ontaardt in deceptie” (ING Boss’ Digital Dream of the Future Deteriorates into a Deception).

Where is ING today on this digital transformation journey?

Well, things are looking up – and the 2022 Investor Day Presentation shows tangible progress on technology platform implementation, customer metrics, and financials. Importantly, there is a subtle change in the wording and the visuals related to this transformation and the overall presentation, reflecting a big change of tone compared to the 2016 plans.

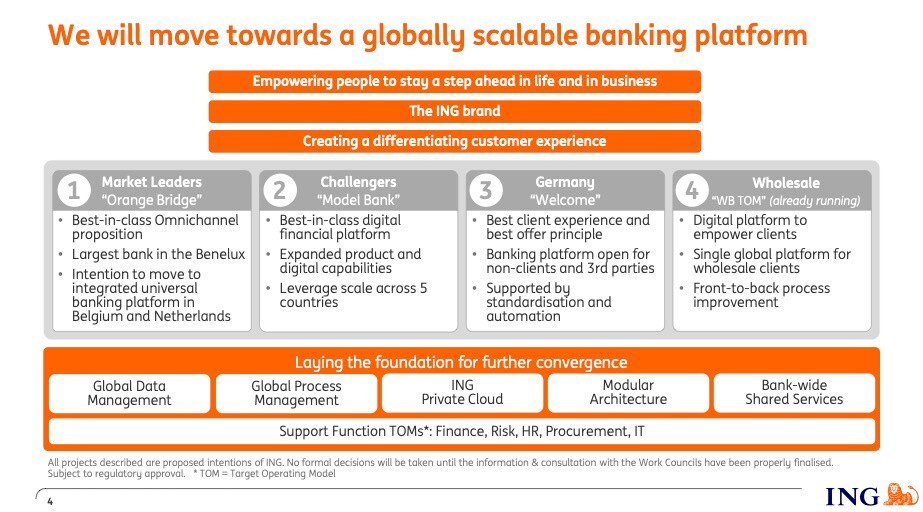

Already in the 2019 Investor Day Presentations, the project name was changed from the “Orange Bridge” (united bank in Benelux) to “Unite be+nl,” describing the two markets as separate peer operations. The wording of the project goal showed a clear shift – explicitly describing the changes in customer experience, using the word “harmonization” rather than “integration”, and being open in naming the source of the expected savings –the number of employees (5,500 in total) who would lose their jobs, rather than an abstract €500 million a year saving promise of the 2016 deck.

In 2022, the transformation is another 3 years further, a different CEO is running the bank, and different people than the names on the 2016 and 2019 Investor Day decks are driving the Digital and Technology Transformation efforts.

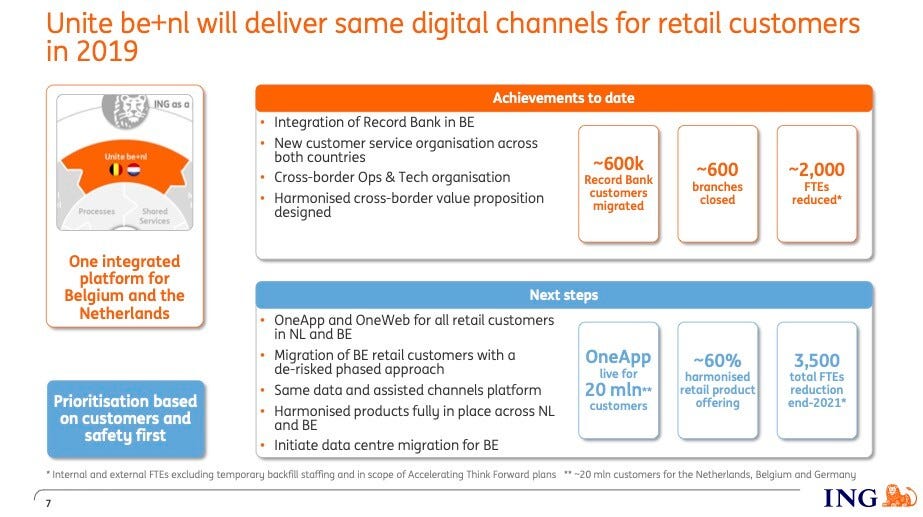

There are no longer separate decks dedicated to “Uniting Belgium and the Netherlands” or a “Transformation Update.” The structure of the ING Investor Day presentations follows the Functional responsibilities of its Management Team. A Technology update is a shared presentation with Operations, united by the focus on Customer Experience and sending a clear signal that Technology transformation is not singling out any specific countries but is a shared foundation across all markets, with a granular approach reflecting differing market maturity.

Belgium got their own page in the Investor Day deck, with the same content as the page for the Netherlands, no longer describing Belgian business as a unification or a merger target, but instead acknowledging both the autonomy of the market and the shared priorities of ING as one bank serving customers in many countries.

In short, the 2022 Investor Day shows significant learnings when it comes to the Four Transformation Paradoxes, and a positive trajectory on all four aspects.

The Big Dream is still big, but it is more flexible, less procedural, and centers on the customer experience rather than on the internal organizational structure.

The Communication tone and priority have evolved significantly. In 2016, the message was a big promise of a technological grandeur and financial savings, and an ambition of being “the biggest.” In 2022, the message is centered around the customer experience, sustainability, and harmonization. It also does not shy away from acknowledging that cost reductions come from thousands of employees losing their jobs, putting a human perspective on the plans.

The Expertise setup has evolved towards a functional structure, the storytelling sends a message of a collaborative and holistic approach, and transformation metrics are more balanced both in terms of the impact (customer usage and satisfaction metrics alongside with the financials) and the levers used (savings that come from optimization of cloud computing costs vs savings from reducing the employee headcount).

Finally, the Leadership has seen a lot of change since 2016, and reflects the 2022 culture, priorities, and expertise needed to take ING forward.

In the upcoming weeks, I will be sharing the insights from my conversations with senior leaders who have been initiating and driving big transformations – and will reveal what they think about these four paradoxes and what makes them successful.

Do stay tuned, and please like, subscribe, and share this Newsletter if you enjoyed reading it!